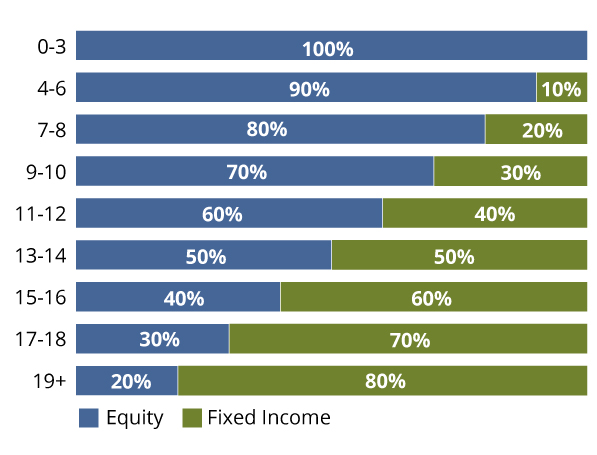

With Age-Based Portfolios, deciding how to invest is easy. The asset allocation within each of our nine portfolios is tailored for children in a particular age group. As your child grows, assets are shifted from a more aggressive portfolio (100% equity) to a more conservative one (20% equity, 80% fixed income) providing greater growth potential when your child is younger, and increased capital preservation potential as your child approaches college. Tax-free transfers between investment options are allowed twice per calendar year.

For more information on the specific risks of these portfolios, please see the Offering Statement.

The asset allocation shown in the table may vary from time to time.

| Fund | SMART529 Select Age-Based Portfolios* | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Age-Based DFA Portfolio 0-3 |

Age-Based DFA Portfolio 4-6 |

Age-Based DFA Portfolio 7-8 |

Age-Based DFA Portfolio 9-10 |

Age-Based DFA Portfolio 11-12 |

Age-Based DFA Portfolio 13-14 |

Age-Based DFA Portfolio 15-16 |

Age-Based DFA Portfolio 17-18 |

Age-Based DFA Portfolio 19+ |

|

| U.S. Core Equity 2 Portfolio | 60.00% | 54.00% | 48.00% | 42.00% | 36.00% | 30.00% | 24.00% | 18.00% | 12.00% |

| International Core Equity 2 Portfolio | 25.00% | 22.50% | 20.00% | 17.50% | 15.00% | 12.50% | 10.00% | 7.50% | 5.00% |

| Emerging Markets ex China Core Equity Portfolio** | 10.00% | 9.00% | 8.00% | 7.00% | 6.00% | 5.00% | 4.00% | 3.00% | 2.00% |

| DFA Global Real Estate Securities Portfolio | 5.00% | 4.50% | 4.00% | 3.50% | 3.00% | 2.50% | 2.00% | 1.50% | 1.00% |

| DFA Short-Term Extended Quality Portfolio | 0.00% | 0.00% | 0.00% | 0.00% | 1.60% | 3.20% | 6.20% | 7.70% | 10.00% |

| DFA Investment Grade Portfolio | 0.00% | 8.20% | 16.40% | 20.50% | 15.80% | 10.90% | 7.10% | 3.80% | 0.00% |

| DFA Five-Year Global Fixed Income Portfolio | 0.00% | 1.80% | 3.60% | 9.50% | 10.60% | 11.90% | 10.70% | 10.50% | 10.00% |

| DFA One-Year Fixed Income Portfolio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 9.40% | 29.80% | 48.50% |

| DFA Short-Duration Real Return Portfolio Portfolio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 2.00% | 6.80% | 9.10% | 11.50% |

| DFA Inflation-Protected Securities Portfolio | 0.00% | 0.00% | 0.00% | 0.00% | 12.00% | 22.00% | 19.80% | 9.10% | 0.00% |

| 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | |

*The actual allocations of the Age-Based Portfolios among their Underlying Funds will fluctuate from time to time. Generally, the Age-Based Portfolios are rebalanced each quarter to maintain the target percentages shown above, although they may be rebalanced more frequently or less frequently as market and other conditions warrant.

**Effective after the close of business on May 21, 2024, the Emerging Markets ex China Core Equity Portfolio was added as an Underlying Fund to the Age-Based Portfolios and certain Static Portfolios, and as of the same date, the Emerging Markets Core Equity Portfolio was removed as an Underlying Fund in each of the Age-Based Portfolios and applicable Static Portfolios.

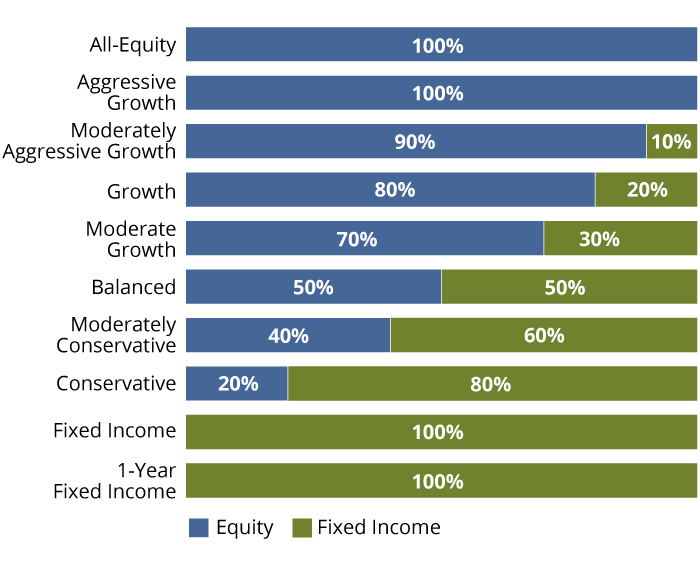

Because investors differ in how long they plan to invest and how much risk they are willing to take, SMART529 Select also offers ten Static Portfolios. Each one differs in its risk and return potential, from more aggressive portfolios invested entirely in equities, to more conservative bond portfolios that invest completely in fixed income securities.

In contrast to the Age-Based Portfolios, Static Portfolios do not change as the child ages. The account owner must decide when and if a change to the allocation is needed. Tax-free transfers between investment options are allowed twice per calendar year.

For more information on the specific risks of these portfolios, please see the Offering Statement.

The asset allocation shown in the table may vary from time to time.

| Fund | SMART529 Select Static Portfolios* | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| All Equity DFA Portfolio | Aggressive Growth DFA Portfolio | Moderately Aggressive Growth DFA Portfolio | Growth DFA Portfolio |

Moderate Growth DFA Portfolio | Balanced DFA Portfolio | Moderate Conservative DFA Portfolio | Conservative DFA Portfolio | Fixed Income DFA Portfolio | One-Year Fixed Income DFA Portfolio | |

| U.S. Core Equity 2 Portfolio | 60.00% | 60.00% | 54.00% | 48.00% | 42.00% | 30.00% | 24.00% | 12.00% | 0.00% | 0.00% |

| International Core Equity 2 Portfolio | 25.00% | 25.00% | 22.50% | 20.00% | 17.50% | 12.50% | 10.00% | 5.00% | 0.00% | 0.00% |

| Emerging Markets ex China Core Equity Portfolio** | 10.00% | 10.00% | 9.00% | 8.00% | 7.00% | 5.00% | 4.00% | 2.00% | 0.00% | 0.00% |

| DFA Global Real Estate Securities Portfolio | 5.00% | 5.00% | 4.50% | 4.00% | 3.50% | 2.50% | 2.00% | 1.00% | 0.00% | 0.00% |

| DFA Short-Term Extended Quality Portfolio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 3.20% | 6.20% | 10.00% | 0.00% | 0.00% |

| DFA Investment Grade Portfolio | 0.00% | 0.00% | 8.20% | 16.40% | 20.50% | 10.90% | 7.10% | 0.00% | 48.60% | 0.00% |

| DFA Five-Year Global Fixed Income Portfolio | 0.00% | 0.00% | 1.80% | 3.60% | 9.50% | 11.90% | 10.70% | 10.00% | 36.40% | 0.00% |

| DFA One-Year Fixed Income Portfolio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 9.40% | 48.50% | 0.00% | 100.00% |

| DFA Short-Duration Real Return Portfolio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 2.00% | 6.80% | 11.50% | 0.00% | 0.00% |

| DFA Inflation-Protected Securities Portfolio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 22.00% | 19.80% | 0.00% | 15.00% | 0.00% |

| 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | |

*The actual allocations of the Age-Based Portfolios among their Underlying Funds will fluctuate from time to time. Generally, the Age-Based Portfolios are rebalanced each quarter to maintain the target percentages shown above, although they may be rebalanced more frequently or less frequently as market and other conditions warrant.

**Effective after the close of business on May 21, 2024, the Emerging Markets ex China Core Equity Portfolio was added as an Underlying Fund to the Age-Based Portfolios and certain Static Portfolios, and as of the same date, the Emerging Markets Core Equity Portfolio was removed as an Underlying Fund in each of the Age-Based Portfolios and applicable Static Portfolios.

Equity |

|

|

Fixed Income |

|